Ready to Get Started?

Join RateShop's Growing Mortgage Broker Team in the US

Funding Across Canada & US

Product Offering Diversity

Training that Matters

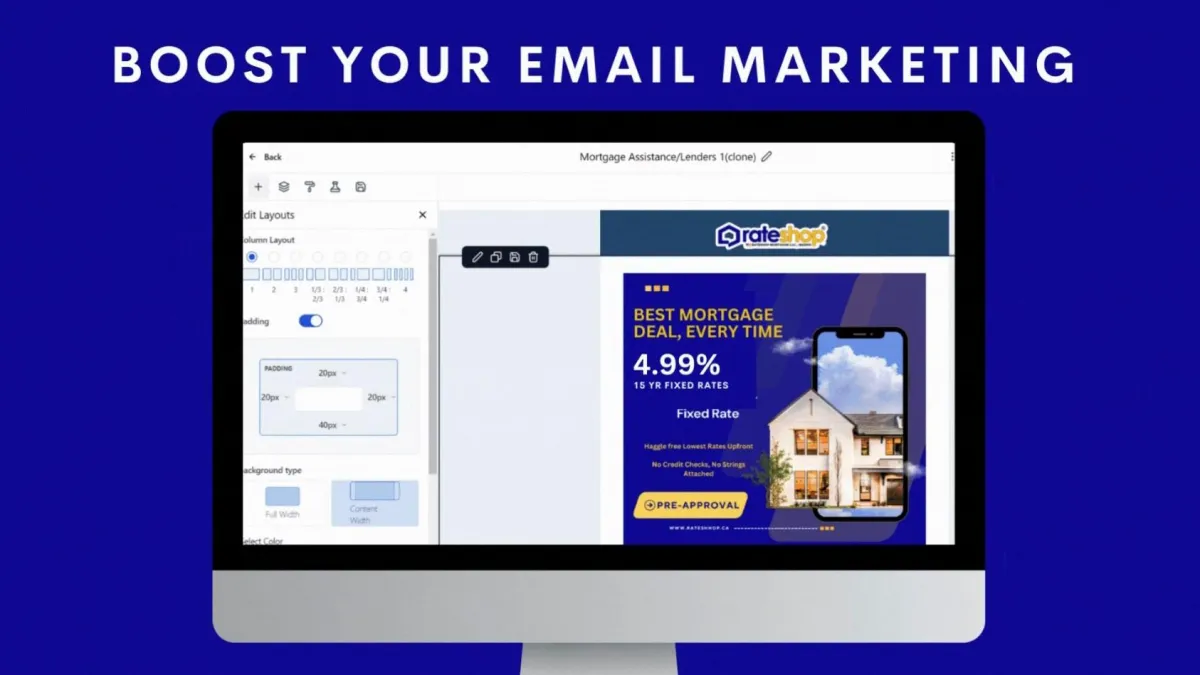

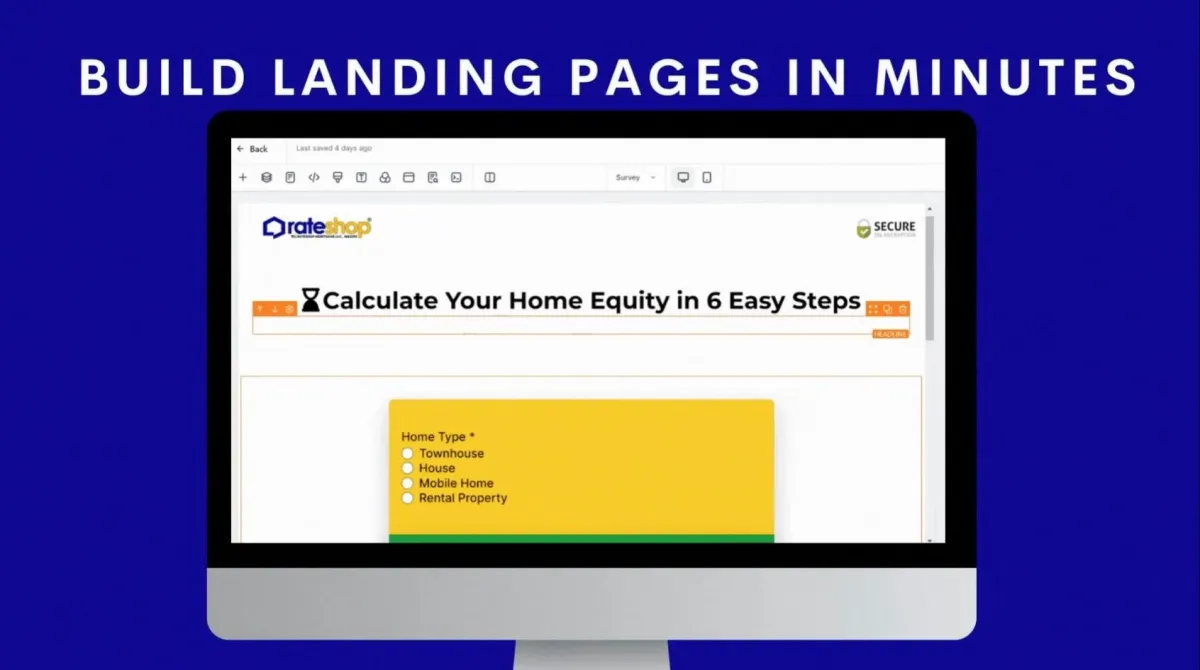

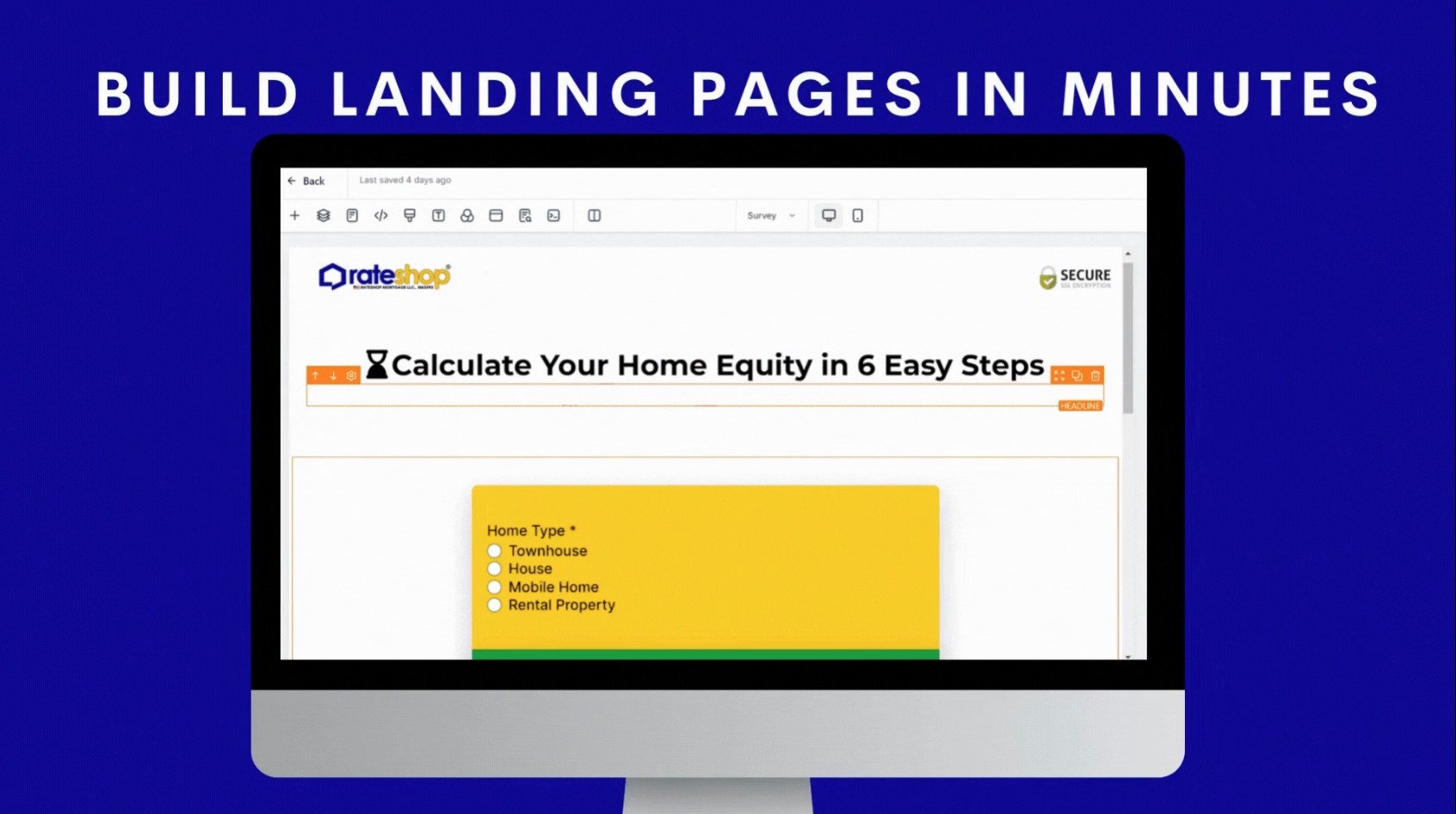

Best Marketing Technology

Top Tier Commissions

Expand in Volume & Revenue

Schedule a 20 minute Online Demo & Start Your Mortgage Journey today!

What’s different about RateShop

RateShop Mortgage offers up to 90% payout, maximizing earnings for Loan Originators and Officers.

RateShop Mortgage LLC connects borrowers to 100+ lenders, ensuring optimal mortgage solutions.

RateShop offers specialty loan programs like FHA, VA, USDA, and Non-QM to meet diverse client needs.

Access to par rates ensures competitive and appealing mortgage pricing for borrowers.

Talk to the Industry Experts

Receive your Hiring Invite Online

E-Learning on Your Pace

Weekly Team Meetings & Training

Best Commission Compensation

Real-time Online UW Support

100% Online Processing & Operations

Our BD & admin team will guide you to a step by step Switch for the Right Reasons!

Request a Meeting

We know it's a life changing career & we can help you make an informed decision.

1 of every 4 brokers are looking for better opportunities, Explore what we can offer today

Start My Registration

Access Training, Lenders and Support in a quick and easy online registration.

We help New & Veteran Mortgage brokers grow their pipeline & teams from scratch.

The RateShop Advantage

Access to 100+ lenders, including FHA, VA, Non-QM, and commercial.

Full CRM access for seamless client management.

Free Loan Origination System (LOS) access.

Full-time processor support included.

Ability to pull your own credit reports.

Par rates from top lenders with no mark-ups.

Approvals for credit scores as low as 500.

Same-day underwriting approvals.

Discounted mortgage insurance premiums.

Training for newly licensed loan officers.

Top 6 Reasons to Join RateShop Mortgage

Considering a career in mortgage brokering? Discover six reasons why RateShop Mortgage is the ideal partner for your success in Florida, Georgia, and Texas!

High Demand for Brokers

With strong real estate markets in FL, GA, and TX, mortgage brokers are in high demand. RateShop Mortgage connects you to a wide client network, boosting business opportunities.

Lucrative Earnings Potential

Mortgage brokers in FL, GA, and TX have high earning potential. With commission-based pay, RateShop Mortgage offers competitive rates and incentives to boost your

income.

Flexible Career

Mortgage broker training offers flexibility with online courses. RateShop Mortgage provides support, training, and coaching to help you succeed.

Complete Training & Support

Mortgage broker certification and licensing are streamlined in these states. RateShop Mortgage offers top training programs and resources to keep you informed and compliant.

Career Growth Opportunities

The mortgage broker career outlook is strong, with growing demand. RateShop Mortgage offers mentorship and resources to help you gain experience and build your business.

Impactful and Rewarding Work

The mortgage broker career outlook is strong, with increasing demand. RateShop Mortgage provides mentorship and resources to help you build your business.

How RateShop Mortgage Can Help

RateShop Mortgage offers comprehensive support to aspiring mortgage brokers in Florida, Georgia, and Texas, including:

Extensive Training Programs:

Access to top mortgage broker training programs and certification courses.

Ongoing Education:

Resources for continuing education to keep you updated with industry trends and regulations.

Competitive Commission Structures:

Lucrative earnings potential with competitive commission rates and incentives.

Mentorship and Business Development:

Guidance and resources to help you grow and succeed in your career.

Client Network:

Connection to a broad network of clients to enhance your visibility and client base.

Exceptional Tools and Resources:

Tools and resources to provide outstanding service to your clients.

Why work with some when you can work with all?

Mortgage Broker Salary Overview

Mortgage brokers in the US have the potential to earn a lucrative income, often based on commission structures. The average salary can vary widely depending on the state and the broker's experience level. Here, we analyze mortgage broker salaries in some of the top states for this profession: Florida, Texas, and Georgia.

High Demand and Competitive Salaries

Florida mortgage brokers earn $50K-$100K, with top earners making more, depending on network, loans closed, and market conditions.

Steps to Become a Mortgage Broker in Florida:

Complete pre-licensing education through approved mortgage broker training programs.

Pass the mortgage broker exam.

Obtain the necessary licensing through the Florida Office of Financial Regulation.

Engage in continuing education to stay updated with industry trends and regulations.

Key Factors Influencing Mortgage Broker Income

Several factors influence the income and compensation of mortgage brokers across different states:

Market Demand: States with booming real estate markets tend to offer higher earning potential for mortgage brokers.

Experience and Network: Experienced brokers with a strong network of clients and real estate professionals typically earn more.

Commission Structure : Mortgage brokers often earn a significant portion of their income through commissions, making the number of loans closed a crucial factor.

Education and Certification: Completing mortgage broker training programs and obtaining the necessary certifications can enhance earning potential.

Mortgage Broker Job Responsibilities

A career as a mortgage broker or mortgage loan originator (MLO) is both rewarding and impactful, blending financial expertise with the ability to help clients achieve their homeownership dreams. Understanding the job responsibilities of a mortgage broker is crucial for those considering this profession. Here, we explore the key duties of a mortgage broker, incorporating essential keywords like mortgage broker certification, training programs, licensing requirements, and more.

Key Responsibilities of a Mortgage Broker

01. Client Consultation and Assessment

One of the primary responsibilities of a mortgage broker is to consult with clients to understand their financial situation, needs, and goals. This involves:

Conducting in-depth interviews to gather financial information.

Assessing credit reports and financial documents.

Advising clients on mortgage products that best suit their needs.

02. Client Consultation and Assessment

Mortgage brokers and mortgage loan originators play a crucial role in the loan application process. Their duties include:

Helping clients complete mortgage loan applications.

Ensuring all required documentation is collected and accurate.

Submitting loan applications to lenders for approval.

03. Market Research and Analysis

A successful mortgage broker stays informed about market trends and mortgage products. This involves:

Researching different loan products and interest rates.

Analyzing market trends to provide clients with the best mortgage options.

Keeping up-to-date with changes in mortgage broker licensing requirements and regulations.

04. Client Consultation and Assessment

One of the primary responsibilities of a mortgage broker is to consult with clients to understand their financial situation, needs, and goals. This involves:

Conducting in-depth interviews to gather financial information.

Assessing credit reports and financial documents.

Advising clients on mortgage products that best suit their needs.

05. Client Consultation and Assessment

One of the primary responsibilities of a mortgage broker is to consult with clients to understand their financial situation, needs, and goals. This involves:

Conducting in-depth interviews to gather financial information.

Assessing credit reports and financial documents.

Advising clients on mortgage products that best suit their needs.

06. Client Consultation and Assessment

One of the primary responsibilities of a mortgage broker is to consult with clients to understand their financial situation, needs, and goals. This involves:

Conducting in-depth interviews to gather financial information.

Assessing credit reports and financial documents.

Advising clients on mortgage products that best suit their needs.

07. Marketing and Business Development

Mortgage brokers often engage in marketing and business development activities to grow their client base. This involves:

Developing a business plan and marketing strategy.

Utilizing social media and online platforms to attract clients.

Attending industry events and networking opportunities to build professional connections.

Prerequisites to Become a Mortgage Broker in Florida, Georgia, and Texas

Becoming a mortgage broker or mortgage loan originator (MLO) in states like Florida, Georgia, and Texas involves meeting specific prerequisites and following a series of steps. This guide outlines the essential requirements and steps to help you embark on a successful career in this dynamic field.

01. Prerequisites for Becoming a Mortgage Broker in Florida

01. Pre-Licensing Education

Complete Pre-Licensing Education: Aspiring mortgage brokers in Florida must complete 20 hours of NMLS-approved pre-licensing education. This education covers federal and state laws, ethics, and mortgage origination practices.

02. Licensing Exam

Pass the SAFE Mortgage Loan Originator Test: This test includes a national component and a state-specific component for Florida. Taking mortgage broker certification courses can significantly improve your chances of passing.

03. Background Check

Criminal Background Check: Submit fingerprints for a thorough criminal background check.

Credit Report: A credit report review is required to assess your financial responsibility.

04. Apply for a License

NMLS Registration: Create an account with the Nationwide Multistate Licensing System (NMLS) and submit your application.

Florida State License Apply for your mortgage broker license through the Florida Office of Financial Regulation (OFR).

Mortgage Broker Licensing Requirements in Florida, Georgia, and Texas

Becoming a licensed mortgage broker or mortgage loan originator (MLO) in states like Florida, Georgia, and Texas involves meeting specific requirements. This guide outlines the essential steps and prerequisites for obtaining a mortgage broker license, integrating the role of an MLO, and showcasing how RateShop Mortgage can assist you in this process.

Mortgage Broker Licensing Requirements in Florida

01. Pre-Licensing Education

Complete Pre-Licensing Education: Aspiring mortgage brokers in Florida must complete 20 hours of NMLS-approved pre-licensing education. This education covers federal and state laws, ethics, and mortgage origination practices.

02. Licensing Exam

Pass the SAFE Mortgage Loan Originator Test: This test includes a national component and a state-specific component for Florida. Taking mortgage broker certification courses can significantly improve your chances of passing.

03. Background Check

Criminal Background Check: Submit fingerprints for a thorough criminal background check.

Credit Report: A credit report review is required to assess your financial responsibility.

04. Apply for a License

NMLS Registration: Create an account with the Nationwide Multistate Licensing System (NMLS) and submit your application.

Florida State License Apply for your mortgage broker license through the Florida Office of Financial Regulation (OFR).

Understanding the Nationwide Multistate Licensing System (NMLS)

The Nationwide Multistate Licensing System (NMLS) is an essential component for anyone aspiring to become a mortgage broker or mortgage loan originator (MLO) in the United States. It serves as the centralized platform for licensing and regulatory information for the financial services industry. This guide provides an in-depth look at what NMLS is, its purpose, and how it impacts the mortgage industry, integrating relevant keywords like mortgage broker certification, training programs, and licensing requirements.

What is NMLS?

The NMLS is a secure, web-based system created to streamline the licensing process for mortgage professionals, including mortgage brokers and MLOs. It was developed by the Conference of State Bank Supervisors (CSBS) and the American Association of Residential Mortgage Regulators (AARMR) to enhance regulatory oversight and consumer protection.

Key Functions of NMLS

01. Centralized Licensing Platform

NMLS provides a single platform for managing state licenses for mortgage professionals. It allows users to apply for, renew, and maintain their licenses in one place, ensuring compliance with state-specific regulations.

02. Uniform Licensing Standards

By establishing uniform licensing standards, NMLS helps ensure that mortgage brokers and MLOs meet consistent education and ethical requirements across states. This includes pre-licensing education, continuing education, and background checks.

03.Consumer Protection

NMLS enhances consumer protection by maintaining a public

access database where consumers can verify the licensing status and history of mortgage professionals. This transparency helps build trust and credibility in the mortgage industry.

04. Regulatory Oversight

The system facilitates better regulatory oversight by providing state regulators with a comprehensive tool to monitor and supervise licensed mortgage professionals. It also aids in identifying and addressing any regulatory issues promptly.

Steps to Use NMLS for Mortgage Licensing

The first step is to create an account on the NMLS website. This account will be used to manage your licensing applications and renewals.

Complete the required 20 hours of NMLS-approved pre-licensing education, covering topics like federal and state mortgage laws, ethics, and mortgage origination.

The test includes both national and state-specific components. Preparation through mortgage broker training programs and certification courses can significantly improve your chances of passing.

Submit fingerprints for a thorough criminal background check.

Provide a credit report for a financial responsibility assessment.

Licensing Fees and Step-by-Step Process Guide for Mortgage Brokers

Becoming a licensed mortgage broker or mortgage loan originator (MLO) involves several steps, each with associated fees. Understanding the licensing process and associated costs can help you prepare financially and logistically. This guide provides a comprehensive overview of the step-by-step process and licensing fees for aspiring mortgage brokers, incorporating relevant keywords like mortgage broker certification, training programs, and licensing requirements.

Licensing Fees for Mortgage Brokers

The fees for obtaining a mortgage broker license vary by state and include several components. Below are typical fees associated with the licensing process:

01. NMLS Registration Fee: Typically $30.

02.Credit Report Fee: Approximately $15.

03. FBI Criminal Background Check Fee: Around $36.25

04. State Licensing Fees:Vary by state, ranging from $100 to $1,000. Some states may also charge an application fee.

Step-by-Step Process Guide for Mortgage Brokers

Step 1: Pre-Licensing Education

1.1. Complete Pre-Licensing Education

NMLS-Approved Courses: Enroll in and complete 20 hours of NMLS-approved pre-licensing education. These courses cover federal and state mortgage laws, ethics, and mortgage origination practices.

Step 1: Pre-Licensing Education

1.1. Complete Pre-Licensing Education

NMLS-Approved Courses: Enroll in and complete 20 hours of NMLS-approved pre-licensing education. These courses cover federal and state mortgage laws, ethics, and mortgage origination practices.

Step 3: Pass the SAFE Mortgage Loan Originator Test

3.1. Schedule the Exam

Exam Components: The SAFE MLO test includes both a national component and a state-specific component. Schedule your test through the NMLS portal.

3.2. Prepare for the Exam

Exam Prep Courses: Utilize mortgage broker exam prep resources and certification courses to increase your chances of passing.

3.3. Take and Pass the Exam

passing Scores: Achieve the required passing scores for both the national and state components of the exam.

Step 4: Submit Background Checks and Credit Report

4.1. Criminal Background Check

Fingerprint Submission: Submit your fingerprints through an approved vendor for a thorough criminal background check.

4.2. Credit Report

Credit Check: Authorize NMLS to obtain a credit report to assess your financial responsibility.

Step 5: Apply for State Licenses

5.1. Complete State-Specific Applications

NMLS Submission: Use the NMLS platform to submit your application for each state where you wish to be licensed. Each state may have unique requirements and fees.

5.2. Pay State Licensing Fees

Fee Payment: Pay the required state licensing fees through the NMLS system.

step 6: Obtain Surety Bond (if required)

6.1. Surety Bond Requirement

State Requirements: Some states require mortgage brokers to obtain a surety bond. Th

e bond amount varies by state and serves as a financial guarantee of your professional conduct.

Step 7: Receive Your License

7.1. Application Review

Regulatory Approval: The state regulatory authority will review your application, background check, credit report, and exam results.

7.2. License Issuance

Receive License: Upon approval, you will receive your mortgage broker license, allowing you to legally operate in your chosen state(s).

Copyright 2024. All Rights Reserved Rateshop.us